BRIDGE - Decentralized Insurance

About Bridge

Bridge Mutual provides a decentralized, scalable and comprehensive smart contract system to ensure smart contracts, stablecoins, centralized exchanges and other crypto and DeFi products. It offers a transparent, auditable and on-chain investment strategy to return returns and profit sharing to its users and does not require KYC or personally identifiable information.

This service increases competition by offering to insure stablecoins and exchanges, not just smart contracts. Additionally, Bridge Mutual is built on top of the Polkadot network, which offers forkless on-chain upgrade capabilities and a superior transaction fee structure.

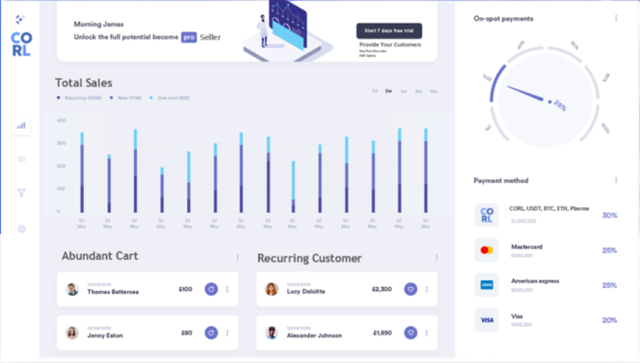

Users can join the Bridge Mutual ecosystem by purchasing BMI tokens and staking BMI on the Bridge coverage pool. Funds in the coverage pool are automatically invested on-chain in other platforms, such as Compound and Aave to generate returns for users. Quotations are generated chained with actuarial formulas; users can connect their Web 3 wallets (Metamask and others) to pay coverage after receiving the offer. A portion of the premium paid by users who purchase coverage is shared among users providing that coverage as an incentive for revenue sharing.

Stablecoin insurance claims are settled instantly. All other claims go through a 3 phase voting process that resolves claims in 6 weeks or less. An incentive system is in place to ensure that every claim is resolved fairly and accurately without fraud or collusion.

This platform does not require any form of identification from its users. All funds in our ecosystem are stored in smart contracts, Bridges are completely non-custodial. No member of the Bridge team has ever had access to the funds staked on the system.

Bridge Mutual has provided legal services for a number of highly visible blockchain projects, including Akropolis, Certik, Kinesis, NOIA, QTUM, FABRK and Gate.io. Bridge Mutual has assembled an outstanding team of insurance and finance experts, as well as other programmers and lawyers. Bridge Mutual aims to be the first platform to provide coverage for the enormous $ 20B stablecoin economy, which is growing at an exponential rate. The project enjoys an over-demand spin of angels and seeds, and is currently in negotiations with a top tier blockchain fund to fill its private spin.

Decentralized

A decentralized and discretionary insurance application, allowing users to insure each other.

Transparent

Blockchain-based, transparent code. Both claims assessment and investment of funds are on-chain and audit-able by the public.

Fair

All claims go through a 3-phase voting process that is enforced with rewards and punishments, ensuring a thorough process for every claim.

Disruptive

Bridge will replace the traditional insurance industry, which is unfair and litigious due to its lack of transparency and misalignment of incentives.

Efficient

Bridge is more efficient than traditional insurance companies, and does not require branch offices, claims specialists, or agents to work.

Quick

The turn-around time for claims and voting is predictable and is always under 6 weeks, regardless of the size of the claim.

Provide Coverage

Choose coins, contracts or exchanges that you think are safe.

Stake your BMI in their pools to provide coverage to customers.

Earn passive yields over time and share profit when people buy insurance.

Purchase Coverage

Choose coins, contracts or exchanges that you want coverage for.

Get a quote and buy discretionary insurance instantly using our app.

Easily make a claim on our app in the event of a crash or an attack.

No KYC

Our platform does not require any form of identification from its users. All funds within our ecosystem are held in smart contracts; Bridge is entirely non-custodial, meaning no Bridge team member ever has access to the funds being staked on the system.

Problem

Smart contracts, stable coins and other crypto products are susceptible to hackers & failures, making it difficult for institutions to enter the market.

Solution

Bridge provides the most transparent and efficient p2p coverage platform, allowing anyone to reliably insure smart contracts, stable coins, and more.

Conclusion

As we know, currently many unwanted events occur in the crypto market, for example, such as the KuCoin hack which caused millions of dollars in losses. We don't want something like this to happen again. And to prevent this we can use insurance services to protect us. Bridge is a decentralized insurance platform that allows crypto users to insure a smart contract, stable coins, centralized exchanges, and more. This is a platform built on the Polkadot network, which will provide users with the most transparent and efficient p2p coverage platform, and allows anyone to reliably insure their assets or maximize their profits by becoming a staker.

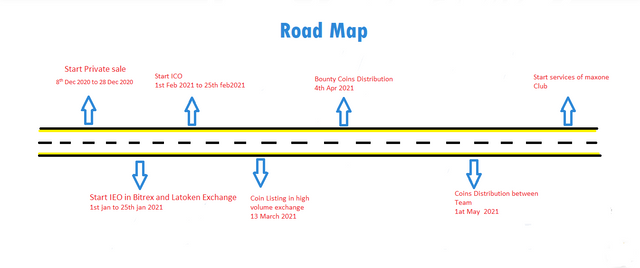

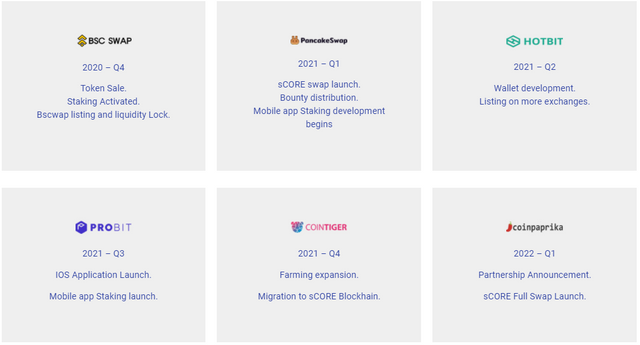

Roadmap

Q4 2020 - Private Sale Development

Q1 2021 - Private Sale Development

Q2 2021 - $100M Coverage Forecast Bridge DAO Governance

Q3 2021 - Product Expansion Capital Pool Growth Coverage Growth

Q4 2021 - Main net V2 Traditional Insurance

For more information

https://www.bridgemutual.io/

https://t.me/bridge_mutual

https://twitter.com/Bridge_Mutual

https://medium.com/@bridgemutual

Author

https://bitcointalk.org/index.php?action=profile;u=2851154